In fact, you can find commercial loan rates as low as 3%, while they cap out around 15%. Commercial real estate loans have some of the lowest interest rates on business loans, partly because the real estate itself serves as collateral for your loan. Put simply, interest rates are just one part of APR loan fees make up the other portion.

#Commercial loan calc full

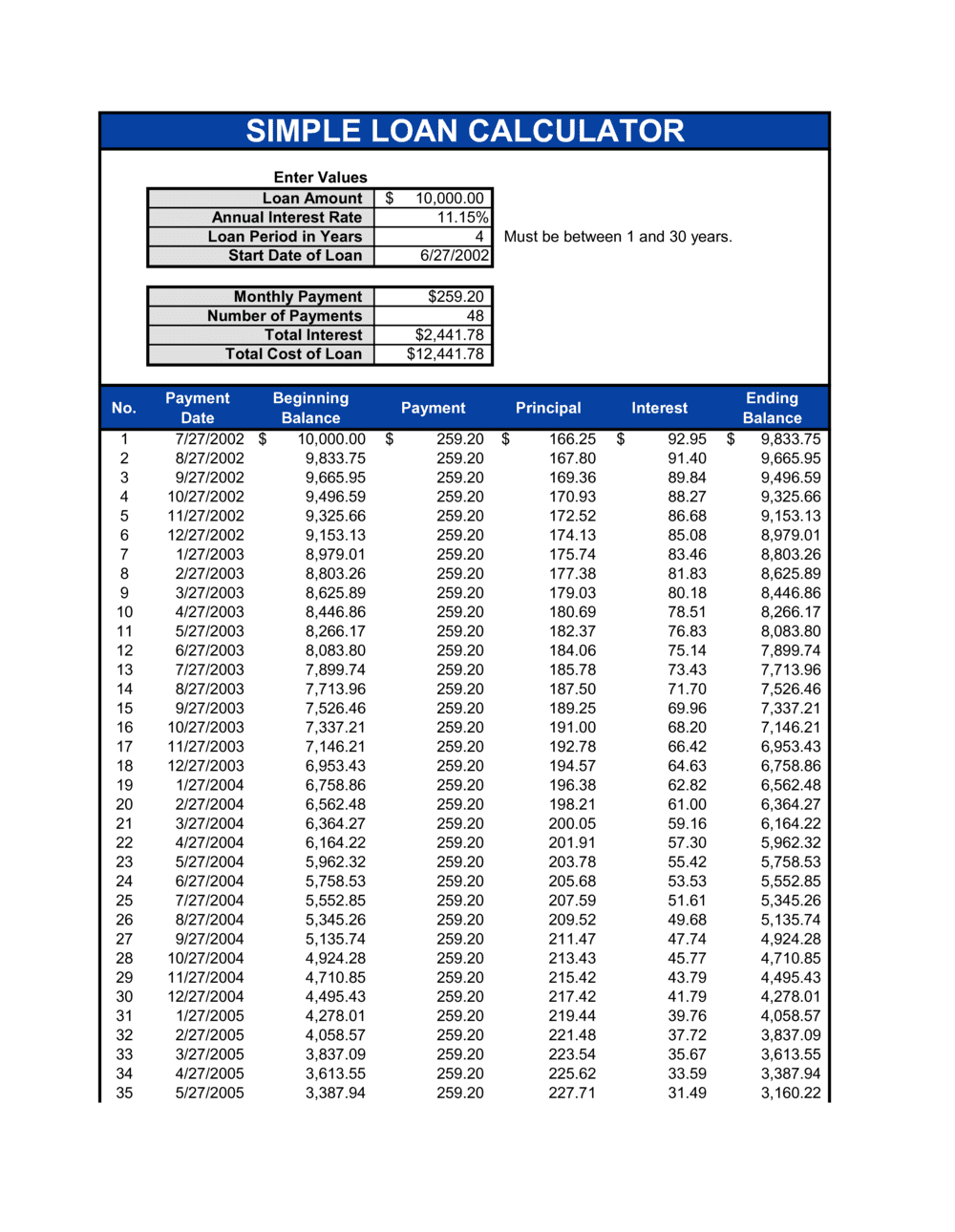

Your annual percentage rate is meant to describe the full cost of your loan over a year. Let’s clear something up right now: APR and interest rates are not the same thing. But there’s more you should know about APR. the loan balance.Īt base, the effect of APR ( annual percentage rate) on your loan is simple: a higher APR translates to a higher loan cost. These tables show you how much each payment would cost you for the duration of your repayment term (the amortization period), as well as how much of each mortgage payment goes toward interest on the loan vs. Plus, after you’ve done your basic calculation, a commercial mortgage calculator lets you view a loan amortization table. (18% goes to interest with the five-year term, and 11% goes to interest with the three-year term.) It will even show you what percentage of your loan cost goes toward interest and what percentage goes toward the loan principle. But a shorter term of three years changes the total to $338,432.75―saving you thousands of dollars.Ī commercial loan calculator can also estimate your monthly payments. Using the loan calculator, you can see that a five-year repayment term makes the total loan cost $364,975.10. Ready to meet your financial goals? Apply now and see what’s possible with a lending partner like Funding Circle.Then you can use the loan calculator to see how the total loan cost changes as those various factors change.įor example, let’s assume you’re considering a $300,000 commercial mortgage with an 8% interest rate. If you feel ready to apply or have questions to ask regarding your small business loan calculator forecast, our team is happy to answer any inquiries you may have. Your small business loan calculator results can help you start to move in the right direction and better prepare your business for applying, securing, and repaying a small business loan.

Our Account Managers will work hand-in-hand with you to craft a custom plan that fits your financial responsibilities and helps to position your business in the best opportunity for success. A loan in this amount provides businesses a significant amount of buying power to address a wide set of needs.

If you are seeking a larger loan, potentially up to half a million dollars, we are able to accommodate those funding needs as well. Your dedicated Account Manager will be able to go into detail about what specific benefits and opportunities we can provide your organization. There are several benefits associated with securing a smaller loan amount through Funding Circle. Loans of this size are most common with small businesses across the United States. If you are seeking a loan in between this range, you’re not alone.

While we offers competitive interest rates, affordable monthly payments, no-prepayment penalties, and other financial benefits, it is our dedicated customer service that makes us a top online lending provider. Understanding Your Small Business Loan Calculator ResultsĬongratulations! You have just received an estimate on your small business loan repayment plan – so what’s next? Getting connected with one of our Account Managers to further discuss your unique organizational needs is the first step toward obtaining the funding you need. This information provided by our small business loan calculator can serve as a jumping-off point for your initial conversations with your dedicated Account Manager at Funding Circle. Our business loan calculator can provide you with an estimate as to what funding amounts are available, and what your monthly repayment range may look like. With a deep knowledge of how small businesses tend to operate, and the roadblocks and growth goals they often face, our Account Managers are able to work closely with you to help you find a funding solution that works best for your business. Our Account Managers have experience helping business owners who have been in the same shoes as you. Having worked with over 100,000 business owners and company leaders like you, we understand your concerns about overextending your budget or the fear of underfunding your projects. When applying for a small business loan, it is necessary to keep in mind what your financial goals are, along with what an affordable repayment plan would look like for your company. Securing a small business loan can open a lot of doors for your organization.

0 kommentar(er)

0 kommentar(er)